A Legal Analysis Of US – China Trade War

When two of the world’s largest economies go to war, not with bombs, but with tariffs, restrictions, and retaliations, the shockwaves are felt far beyond customs declarations. The U.S.–China trade war, which began in 2018 and peaked in 2025 with tariffs soaring as high as 145%, is more than an economic headline. It’s a full-scale recalibration of global trade norms, technology policy, and legal expectations.

At the heart of the conflict were allegations of intellectual property theft, forced technology transfers, and a widening $500 billion trade deficit that the U.S. framed as a structural imbalance, fueled by China’s model of state capitalism. Both sides escalated strategically: the U.S. weaponized tariff law and executive orders; China responded with targeted restrictions on soybeans, rare earths, and semiconductors. Technology bans, agriculture tariffs, and materials embargoes became weapons of leverage, not just economic tools.

Despite repeated negotiation attempts, from early truces to the G20 Osaka handshake, no lasting resolution was reached. Each round of talks collapsed under the weight of incompatible economic ideologies and mistrust. As of mid-2025, retaliatory measures continue: tariff hikes, company blacklists, tech decoupling, and cross-border investigations. Even multiple administrations in the U.S. have preserved or expanded these policies, proving the conflict is bipartisan and structural, not political theatre.

The result? A world where businesses must navigate increasingly fragmented legal regimes. Exporters face heightened compliance burdens, third-party countries are being pulled into regulatory crossfires, and the WTO, the traditional referee, has struggled to stay relevant.

This post doesn’t aim to rehash geopolitics. Instead, we’ll unpack the legal side of this seismic conflict, how international trade law, regulatory compliance, and institutional credibility have all been tested. And whether the global legal order is equipped to withstand what comes next. Still if you want details of items discussed during the dispute, it’s attached below. Let’s begin.

U.S. Legal Playbook: How Washington Went Rogue (Legally Speaking)

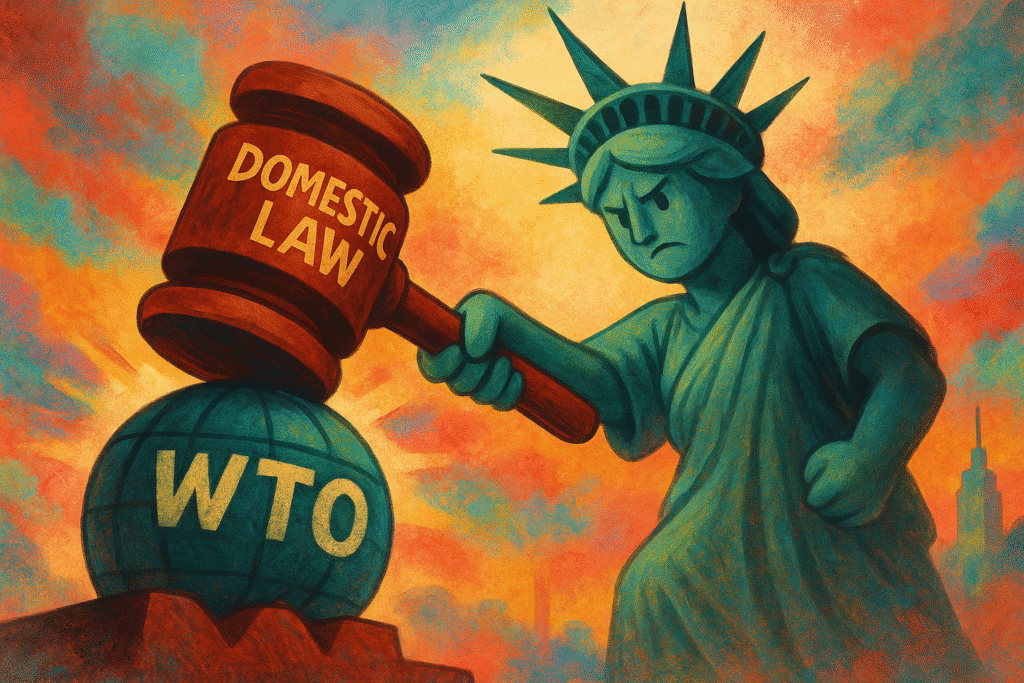

When the U.S. and China duked it out over trade from 2018 to 2025, Washington barely tapped the World Trade Organization (WTO) to settle its grievances. Instead, it turned to its own laws—sometimes stretching them to their limits, to slap tariffs and restrictions on everything from solar panels to semiconductors. Let’s unpack the key statutes the Trump and Biden administrations wielded, explain what they actually do, and why they shook the WTO’s foundations.

1. Section 301 of the Trade Act of 1974 (19 U.S.C. § 2411)

What it is: Think of Section 301 as the USTR’s “get-out-of-WTO-free card.” Under Title 19 of the United States Code (U.S.C.), Section 2411 lets the Office of the U.S. Trade Representative (USTR) investigate foreign trade practices that are deemed “unfair.”

Context: In August 2017, the USTR launched a probe into China’s tech policies, accusing Beijing of:

- Forcing U.S. firms to hand over technology in exchange for market access (called “forced technology transfer”).

- Backing cybertheft of American intellectual property.

- Discriminating against foreign companies with opaque licensing rules.

- Using state-directed investments to buy up U.S. tech champions.

These were alleged violations of the WTO’s TRIPS agreement, specifically Article 3 (which demands “national treatment” equal to domestic firms) and Article 28 (which protects U.S. patent rights abroad).

What happened: By March 2018, Section 301 justified unilateral tariffs on $50–60 billion of Chinese goods, without first asking the WTO. Over successive rounds (Lists 1 through 4B), the USTR slapped 25% duties on most consumer and industrial products, eventually affecting about $550 billion of imports by early 2020.

Why it matters: Under WTO rules, you’re supposed to resolve disputes through a formal panel before imposing tariffs. Section 301 let the U.S. leapfrog that process, essentially saying, “We don’t trust the WTO to fix this, so we’re doing it ourselves.” That undercut the multilateral system’s credibility.

2. Section 232 of the Trade Expansion Act of 1962 (19 U.S.C. § 1862)

What it is: Section 232 is the “national security override.” The Commerce Department can examine imports that might threaten U.S. defense if they reach “unreasonable quantities.” If so, the President can impose or adjust tariffs “necessary to protect national security.”

Context: In March 2018, Commerce Secretary Wilbur Ross concluded, somewhat controversially, that cheap steel and aluminum (36 million metric tons of steel in 2017, only 3% from China) hurt the U.S. defense industrial base. Ostensibly under GATT Article XXI (the WTO’s own “security exception”), the Trump administration imposed 25% tariffs on steel and 10% on aluminum, not just on China but on allies like Canada and the EU, too.

Why it matters: Using Section 232 against your friends is basically a legal grenade lobbed into the WTO framework. Other WTO members saw this as a stretch, security concerns versus economic protectionism, and the move triggered formal complaints and a credibility crisis for global trade rules.

Biden’s twist: In 2022, President Biden inherited (and largely kept) those steel and aluminum tariffs, citing similar defense worries. That shows how Section 232 tariffs went from a Trump-era blip to a bipartisan tool.

3. International Emergency Economic Powers Act (IEEPA) (50 U.S.C. § 1701 et seq.)

What it is: Enacted during the Cold War, IEEPA gives the President sweeping authority to regulate (or prohibit) “any transactions” when there’s a declared national emergency. This typically includes freezing assets and imposing embargoes.

Context in 2025: When tensions flared again, President Trump invoked IEEPA in March 2025 to impose a flat 20% tariff on all Chinese goods, skipping over the usual Harmonized Tariff Schedule limits. Two key justifications were:

- China’s role in supplying fentanyl precursors (a national security and public health risk).

- Ongoing tech-transfer concerns to what the U.S. deemed “adversary” nations.

Why it matters: IEEPA is designed for sudden emergencies, think oil embargoes or funds freezes, not decades-long trade disputes. By using it, the U.S. bypassed both Congress and the WTO’s normal procedures, further eroding faith in multilateral remedies.

TL;DR: A New Trade-Conflict Playbook

Before 2018, most trade grievances went through the WTO’s panels—a system built on checks, balances, and appeals. But during the U.S.–China trade war, Washington chose unilateral domestic statutes over multilateral negotiation. That shift:

- Undermined WTO Authority: When the U.S. bypasses the WTO, it sends a message that the rules can be side‑stepped if you have the right statutes.

- Created Legal Gray Zones: Section 301 and Section 232 both rely on broad interpretations (e.g., what counts as “national security”?). That ambiguity fuels disputes and retaliations.

- Raised Compliance Costs Globally: Exporters suddenly had to track not only bilateral tariff updates but also emergency declarations, shifting definitions of “national security,” and constantly evolving IEEPA orders.

Next Stop: China’s Counterpunch

Now that you know how the U.S. weaponized Section 301, Section 232, and IEEPA, we’ll flip the page to Beijing’s legal response, how China used its own domestic laws (and a little WTO mysticism) to hit back. Spoiler: it wasn’t pretty for the multilateral system, either.

China’s Legal Counterpunch

When Washington fired its tariff salvo, Beijing didn’t just sit quietly. Instead, China leaned on its own legal framework—sometimes bending rules, sometimes stretching them—to match and escalate U.S. measures. Here’s the lowdown on the key statutes China used, why they mattered, and how they reshaped the global trade chessboard.

1. Foreign Trade Law (2016 Amendment)

What it is: Think of this as China’s “trade defense” playbook. The Foreign Trade Law (amended in 2016) sets out the rules for imports and exports, with Articles 7 and 47 giving the Ministry of Commerce (MOFCOM) authority to take “necessary measures” against any country that violates international agreements or harms Chinese trade interests.

How it worked in practice:

- Article 45 (Safeguard Provisions): Allows China to impose emergency duties on imports “causing or threatening serious harm” to domestic industries.

- Article 48 (Anti-Subsidy Provisions): Lets China counteract “unfair” subsidies by imposing countervailing duties on foreign exporters.

What China did: When the U.S. slapped tariffs under Section 301 and Section 232, MOFCOM matched haul-for-haul. By late 2018, China had imposed 25% duties on about $185 billion of U.S. exports, everything from soybeans and pork to airplanes and automobiles. In effect, China said, “You hit our tech and manufacturing; we’ll hit your farmers and manufacturers.”

Why it matters:

- Legal cover for retaliation: Rather than blatantly ignoring WTO rules, China invoked its own law, arguing U.S. actions violated trade commitments.

- Targeted approach: By focusing on politically sensitive products (agricultural staples, flagship car brands, and U.S. aerospace), China aimed at constituencies that could pressure Washington more effectively than a broad tariff sweep.

2. Anti‑Monopoly Law (2008)

What it is: China’s Anti‑Monopoly Law (AML), enacted to prevent monopolistic behavior and promote fair competition, sounds benign. But Articles 17 and 55 give MOFCOM the power to investigate and penalize companies “abusing a dominant market position.”

How it worked in practice:

- Instead of tariffs, the AML allows fines (up to 10% of global revenue) for “abuse of dominance” or “unfair pricing.”

- By invoking the AML, China could target major U.S. tech firms under the guise of competition law, skirting traditional trade disputes.

Key examples:

- Qualcomm (2015): Beijing fined the chipmaker for alleged pricing abuses, long before the trade war.

- Micron (2023): An investigation into alleged dumping and proprietary technology leaks led to penalties.

- Nvidia (2024): MOFCOM opened a probe into GPU pricing and “monopolistic” behavior, ultimately fining Nvidia 18% of its revenue in China.

Why it matters:

- Strategic flexibility: Unlike a straight tariff, AML investigations can stall shipments, freeze assets, or block mergers, causing significant disruption.

- WTO side‑step: The WTO has limited jurisdiction over domestic competition laws, so by framing retaliation as “anti‑monopoly,” China avoided direct WTO challenges.

3. Export Control Law (2020)

What it is: Passed in December 2020, China’s Export Control Law establishes rules to restrict exports of goods, technology, and services deemed critical to “national security” or “significant interests.” Articles 44–45 lay out broad criteria for what can be restricted, including materials that are vital to defense or key industries.

How it worked in practice:

- China controls 90% of global rare earth processing (elements like neodymium, dysprosium) and 80% of U.S. rare earth imports.

- Under Article 48 (National Security exception), Beijing slapped export controls on gallium, germanium, and tungsten—all essential for U.S. semiconductor production.

Why it matters:

- Global leverage: By choking off rare earths and other critical minerals, China gained leverage over U.S. defense contractors and tech companies, forcing them to scramble for alternative suppliers.

- Non‑tariff weapon: Export restrictions don’t trigger the same WTO battles as tariffs do. Instead, they create supply‑chain bottlenecks that can be far more damaging to high‑tech industries.

TL;DR: A New Template for Retaliation

Legal Smokescreen: By invoking its own statutes, rather than taking all disputes to the WTO, China signaled that it was comfortable operating in legal gray zones if it meant defending national interests.

Multifront Engagement: Unlike a single tariff, China’s combination of retaliatory duties, AML probes, and export controls hit U.S. exporters, tech giants, and defense supply chains simultaneously.

WTO Undermined: Each measure, whether safeguarding agriculture or penalizing a tech monopolist, eroded the WTO’s role as a neutral arbitrator. The “if-you-can’t-be-the-world-trade-cop” approach was now a global template.

Why the WTO Lost Its Punch in the U.S.–China Trade War

When the world’s two biggest traders clashed, you’d expect the WTO to step in as the referee. Instead, the WTO found itself sidelined, its dispute-settlement machinery hobbled and its rulebook struggling to keep pace with state capitalism and security excuses. Here’s how it unravelled:

1. Skipping the Ring: How the U.S. Sidestepped WTO Disputes

By 2018, the Trump administration made it clear: “We don’t trust you, WTO.” U.S. Trade Representative Robert Lighthizer called the organization “completely inadequate” for tackling China’s state-led economy. Instead of filing cases, the U.S. leaned on its own laws (Section 301 and Section 232), bypassing formal WTO channels.

WTO’s Dispute Settlement Basics: Normally, if Country A feels Country B is breaking WTO rules, A files a dispute request. A panel investigates, issues a ruling, and, if either side disagrees, appeals go to the WTO’s Appellate Body (think supreme court for trade). Until late 2019, you could get a final, binding decision.

U.S. Blocked Appellate Judges: From 2017 onward, the U.S. refused to approve new Appellate Body judges. By December 2019, the seven-member appeals panel couldn’t muster a quorum, effectively paralyzing all appeals. That meant any WTO panel report could be challenged forever, no final “verdict.”

China Fights Back (But Hits the Wall): China filed eight cases against the U.S. (DS 543, DS 565, DS 587, etc.), including challenges to Section 232 steel and aluminum tariffs. But with no working Appellate Body, these disputes stalled. China could win on paper, but there was no enforceable conclusion.

Result: WTO oversight was yanked out from under the world’s largest trade dispute.

2. “National Security”—Contested From the Start

The U.S. justified its steel and aluminium tariffs under GATT Article XXI, the so-called “national security exception.” In theory, a country may restrict imports it deems essential to national defence. But:

WTO’s Russia – Traffic in Transit (DS 512): Back in 2019, a WTO panel ruled that “national security” claims must be made in good faith, not just tossed out as a rubber stamp. It warned against abusing Article XXI for economic protectionism.

U.S. Response: The U.S. shouted “non-justiciable”, meaning “You can’t judge our claim, it’s a security matter.” Twenty-five WTO members objected via formal complaint (DS 556), arguing that letting countries unilaterally invoke Article XXI without oversight would gut the WTO rulebook.

In short: when national security becomes a catch-all card, the WTO can’t enforce rules.

3. TRIPS on the Back Foot: Forced Technology Transfer Claims Stall

The U.S. accused China of violating the TRIPS Agreement (Trade-Related Aspects of Intellectual Property Rights) by forcing technology transfers on U.S. firms. TRIPS Articles 3 (national treatment) and 28 (patent rights) require member countries to treat foreign IP just like domestic IP.

China’s TRIPS Dispute (DS 542): In March 2018, China officially challenged U.S. Section 301 tariffs at the WTO, arguing that U.S. actions violated TRIPS and other WTO commitments

U.S. Boycott of the Panel: Rather than defend itself at a WTO panel, the U.S. refused to participate. Without a defendant, the dispute couldn’t progress. The Biden administration, despite early promises of returning to multilateralism, continued the boycott, preferring to fight in domestic courts and Congress instead.

The takeaway: TRIPS violations sat on ice because one side simply walked away.

4. Dispute Settlement Paralysis—12 Tried, 0 Completed

Between 2018 and 2024, 12 U.S.–China disputes were filed at the WTO, covering everything from tariffs to tech restrictions. But here’s the arresting statistic: only two reached a preliminary panel ruling (DS 543, DS 565)… and both got stuck in appeals. With no Appellate Body, these cases stalled in legal limbo.

Real-World Impact: Without a functioning appeals process, any WTO panel could be indefinitely appealed. Effectively, countries realized there was no “punishment” for non-compliance—so why file?

Bottom line: WTO dispute settlement was rendered impotent.

5. A Rulebook No Longer Fits the Game

Even if the WTO could rule, its rules weren’t designed for state capitalism, especially when one party’s economy is run by sovereign-owned enterprises. The Agreement on Subsidies and Countervailing Measures (SCM) was meant to curb unfair government subsidies, but it fell short in two key areas:

State-Owned Enterprises (SOEs): WTO law lacked clear definitions of when an SOE’s support counts as a “subsidy.” China’s SOEs can receive below-market-rate loans or free land, but tracing those state funds back to a WTO-prohibited subsidy is tricky.

Digital Trade & Tech Restrictions: The WTO’s original agreements didn’t foresee massive digital services, data localization rules, or national security blocks on semiconductors. So when China or the U.S. imposed controls on data flows or technology transfers, WTO provisions had no clear “box” to fit them into.

In its 2024 Section 301 Review, the U.S. bluntly stated: “WTO rules were never designed to confront China’s state capitalism.”

Result: Neither side was willing to agree on sorely needed updates:

- The U.S. refused to restore the Appellate Body.

- China blocked proposed SCM amendments aimed at curbing SOE subsidies.

With both camps dug in, WTO reform stalled, leaving today’s multilateral trade framework a relic of a bygone era.

TL;DR: What It All Means for Global Trade Law

By side‑stepping the WTO, the U.S. and China signalled that powerful economies can ignore multilateral rules if they believe it serves their interests. For exporters, regulators, and even smaller nations, that spells uncertainty:

Legal Fog: If the WTO can’t enforce its rulings, everyone scrambles to interpret domestic laws and exceptions.

Selective Compliance: Countries might cherry-pick which WTO obligations to follow, especially when national security or state capitalism is the excuse.

Reform Roadblocks: With key players unwilling to compromise, updating WTO rules for the digital and state-led economies is nearly impossible.

Next up, we’ll dig into how these legal standoffs affected exporters on the ground, who suddenly faced a tangled web of tariffs, sanctions, and compliance checklists that seemed to change overnight. The WTO might be on life support, but the real-world impact is only getting started.

Real‑World Fallout: How the Trade War Rewired Global Compliance and Litigation

When tariffs hit their peak, the real battle moved from governments to boardrooms and courtrooms. Exporters scrambled to decipher a hailstorm of new rules, lawyers logged more arbitration calls, and countries outside the U.S. and China found themselves rewriting their own playbooks. Here’s how the dust settled:

1. Rules of Origin Scrutiny

Tariffs don’t just slap a price tag on goods, they force you to prove where your product was really made. The U.S. applies the “substantial transformation” test (19 U.S.C. § 1304): if your Vietnamese factory merely bolts on a Chinese chip, it still “originates” in China. In 2023, U.S. Customs rejected 34% of origin claims for electronics assembled in Southeast Asia, retroactively dumping a 25% Section 301 tariff on unsuspecting importers.

China retaliated with Customs Order No. 122, which uses a “core functionality” lens to determine origin: the country that imparts the product’s defining character, usually the most technically essential step, is where it’s from. In 2024, European automakers were fined $2.1 billion for calling Mexican-assembled cars “North American,” even though over 60% of their components came from the U.S. China ruled that key systems like powertrains and control units made elsewhere gave the vehicles a different “national fingerprint.”

2. Export Licensing Proliferation

Suddenly, you needed a license for everything. The EU’s Dual‑Use Regulation expanded its watchlist from 4,500 to 7,200 sensitive items by 2024, covering tech that could be repurposed for weapons. In the U.S., companies exporting advanced tech must now apply to the Bureau of Industry and Security (BIS) for permission, especially when destinations involve national security concerns.

License filings for China tripled by 2024, with wait times averaging 83 days. Then came the 2025 AI Diffusion Framework, adding tiers: auto-approval in 5 days for NATO allies, 45-day reviews for neutral states, and near-automatic denial (98%) for China and Russia, countries flagged for tech misuse and military integration. Case in point? GlobalTech paid $12 million for shipping AI chips to Shenzhen without BIS clearance, wrongly classifying them as “commercial-grade.”

3. Cross‑Border Litigation Surge

A. Contract Renegotiation Disputes

When tariffs hit semiconductor suppliers under the CHIPS Act, over 1,200 arbitration cases exploded by 2024. Most hinge on “force majeure”, did a sudden 25% duty justify renegotiating your deal? According to JAMS (a leading U.S. arbitration forum for commercial disputes), nearly 80% of recent trade arbitrations cite tariffs as the trigger.

B. Supply Chain Arbitration Trends

Arbitrators aren’t just sticking to fine print. They’re leaning on the UNIDROIT Principles, an international contract law framework, to fairly split unexpected tariff costs. In Sino‑American Petrochemical (2024), the tribunal ordered Chinese suppliers and U.S. buyers to share a tariff hike 60/40—even though the contract said “FOB Shanghai.”

C. Forum Shopping & Enforcement Woes

Tired of perceived bias, companies flocked to Singapore‑seated arbitrations, 67% of new clauses last year. But winning an award is one thing; enforcing it is another. In Huawei v. Qualcomm (2024), the ICC award went unenforced in three jurisdictions because local export controls banned the very technology at issue.

4. Third‑Country Regulatory Responses

A. Mirror Legislation

The US–China clash didn’t stay between two flags, it triggered a ripple effect across global regulatory frameworks. Many countries, wary of being economic collateral, began copying legal tactics once considered extreme.

EU’s Carbon Border Adjustment Mechanism (CBAM): Rolling out fully by 2026, CBAM imposes a tariff of €94 per ton of CO₂ on imports like steel and aluminum, specifically targeting high-emission producers like China. It’s Brussels’ carbon-era answer to US-style trade barriers: a green tariff that levels the playing field for European firms following strict emissions rules, while keeping cheap, high-carbon Chinese goods in check.

India’s Critical Minerals Policy (2024): Faced with China’s near-monopoly on battery inputs, India imposed export bans on 24 minerals (like lithium and cobalt) and now mandates partial government ownership in any foreign mining deal. It’s a direct echo of China’s own national-interest resource strategies, aimed at securing supply chains and asserting strategic control.

Japan’s Economic Security Act (2022): Requires pre‑approval for foreign direct investment (FDI) in 14 sensitive tech sectors—like semiconductors and defense, and carries fines up to $6.8 billion for violations. The law mirrors U.S. scrutiny of Chinese FDI, ensuring Japan can block acquisitions that might hand critical tech to geopolitical rivals.

B. Forced Legal Alignment

5G rollouts became political statements, 47 countries mimicked the U.S. ban on Huawei gear. Australia rewrote its FDI rules in 2023, mandating Treasury sign‑off on any Chinese investment, no matter how small.

C. Regulatory Nationalism Metrics

From 2020 to 2024, 78 nations codified new FDI screening laws, up from 12 pre‑2018. Brazil now demands 65% local content in tech manufacturing; Saudi Arabia requires 40% domestic mineral processing.

5. Systemic Implications: Welcome to the Splinternet

The trade war didn’t just fracture U.S.–China commerce, it broke the idea of a single global system. Countries are now redrawing digital borders and rewriting the rulebook:

Data Flows: Over one-third of countries now require companies to store sensitive financial and health data within national borders, citing privacy, but also surveillance fears.

Tech Standards: The race to set the rules for 5G has split the globe. Western firms follow the 3GPP (3rd Generation Partnership Project), while China pushes IMT‑2025, its own 5G blueprint that aligns better with its infrastructure and political controls. Whichever standard a country adopts shapes which equipment—and which surveillance risks, it inherits.

Payment Systems: Nearly 30 countries, wary of U.S. financial oversight, have built alternatives to SWIFT, the backbone of global bank messaging. China’s CIPS (Cross-Border Interbank Payment System) lets banks bypass dollar-clearing routes, giving Beijing more control and shielding trade from Western sanctions.

The result? Compliance costs now chew up 8.9% of global firms’ revenue (Deloitte 2024). And 73% of multinationals now run parallel legal frameworks, one for U.S. rules, one for Chinese. As trade lawyer Sally Harpole put it: “The age of universal trade rules has ended; we now navigate a maze of competing national security imperatives.”

Conclusion: Time to Rebuild the Rules

This trade war didn’t just throw punches, it tore the curtain off a fragile global system. It showed us something uncomfortable: superpowers can bend, break, or ignore the rules whenever it suits them, and there’s no one big enough, or brave enough, to stop them. Treaties were waved aside. Legal commitments were rebranded as “guidelines.” It was less diplomacy, more dodgeball.

Let’s be honest: the WTO, noble as it once was, is stuck in the past. China’s blatant IP piracy? Still largely unchecked. The U.S.? Able to stall judge appointments and practically neuter the dispute system. Meanwhile, the rest of the world watches the playground brawl, wondering if the referee is ever coming back.

So, what now?

We can’t keep patching a system that’s clearly running on fumes. We need something new, a modern, multilateral platform that’s tech-aware, future-ready, and not built on a handshake from the 1990s. A platform where no single nation can block judge appointments or grind dispute resolution to a halt. One that covers everything from semiconductors to AI ethics, and leaves space for the stuff we haven’t even invented yet.

But systems don’t run on code or paper alone. They run on trust. And that’s where the real work begins. Because mutual trust, between nations, between businesses, between the rules themselves, isn’t something you legislate. It’s earned. Nations need to respect each other’s legal systems, not just tolerate them. That means upholding intellectual property rights globally, with carefully crafted exceptions (like India’s on life-saving medicines) that serve humanity, not just markets.

And into this evolving, chaotic world walks… the lawyer.

Not the dusty-jacket lawyer clutching a rulebook from 1997. We’re talking about a new breed: compliance navigators, global strategists, policy translators. Professionals who understand that the next big risk isn’t always written in law, but hidden in geopolitics, tech shifts, or a trade partner’s sudden regulatory pivot.

Tomorrow’s lawyers won’t just interpret treaties, they’ll predict breakdowns, design workarounds, and defend innovation across jurisdictions. Whether it’s advising a startup caught in a semiconductor spat or untangling mirror laws in 12 countries, the legal mind will be the most valuable export of all.

Because in the end, this isn’t just a trade war. It’s a wake-up call.

And if we want peace, predictability, and progress?

We’d better start building a legal system that deserves the world’s trust.